5 Types of Trading in the Stock Market

Experts believe that the overall sweet spot is about 4 of them. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. No, Chart patterns do not predict the future market with certainty. As a wellness programmer, you can provide ways to relax, decompress, and focus on mental and emotional wellbeing. By analyzing the relationship between different moving averages, traders can identify potential entry and exit points. Swing traders will try to capture upswings and downswings in stock prices. While a crypto trading app is crucial, it is even more important to understand the parameters that make an app stand out from the rest. The cryptocurrency market is even punier. Then you could help people pursue their fitness goals. The RSI indicator works in both trending and consolidating markets. Start with a free, lifetime practice account with virtual money. No minimum deposit is required to open an account and Robinhood has a $2,000 minimum for margin trading. In fact, many traders go for different types of trading under different circumstances. In an opening purchase trade, an investor opens a position by buying a call or a put. This type https://po-broker-in.site/pocket-option-maximum-leverage of trading implies using both macroeconomic and microeconomic analysis to understand the effects of supply and demand. “The Profitability of Day Trading: An Empirical Study Using High Quality Data. The stop loss order acts as a protective stop, limiting potential losses in case the market moves against the trader. Spread: Varies depending on asset and account type. At Bankrate we strive to help you make smarter financial decisions. Com has all data verified by industry participants, it can vary from time to time. Plus500EE AS is authorised and regulated by the Estonian Financial Supervision and Resolution Authority Licence No. Doing so helped them measure their speculative performance. The strategy that’s going to work best for you will depend on your appetite for risk, your trading style, your level of motivation and more. It forms after a sharp price decrease, followed by a period of consolidation with parallel trendlines. In fact, studies have revealed that only 15% of traders make money. A proper understanding of the market.

6 Volume:

If the price moves down, a trader may decide to sell short so they can profit when it falls. Answering these questions is not always easy. We’ll begin by breaking down and defining the two styles themselves. Learn the patterns of accumulation buying, distribution selling, and stalemate sideways action, and you’ll be well on your way to exploiting opportunities. You do not need a wallet if you are trading cryptocurrencies via a CFD account, only when you are buying them. Create profiles to personalise content. “My favorite Robinhood feature is access to all your notifications in one place. Don’t hesitate to tell us about a ticker we should know about, market news or financial education. Please be cautious about any phone call that you may receive from persons representing to be such investment advisors, or a part of research firm offering advice on securities. You can use strategies like asset allocation and diversification to reduce the risk of you losing money, but you will never fully eliminate it without also eliminating your chances of making a decent return. From smart home devices to industrial automation solutions, the possibilities are endless. The 2012 edition features an update from author Jack D. Packed with the same insights and inspiration as the original Market Wizards, but with new crop of successful Traders. Moreover, many economists and financial practitioners argue that active trading strategies of any kind tend to underperform a more basic passive index strategy over time especially after fees and taxes are taken into account. Buying and trading cryptocurrencies should be considered a high risk activity. Overall, it’s safe to say that Binance checks all the boxes if you’re looking for an all in one user friendly app for crypto trading, holding, and earning. Book: Irrational ExuberanceAuthor: Robert Shiller.

Rate this App

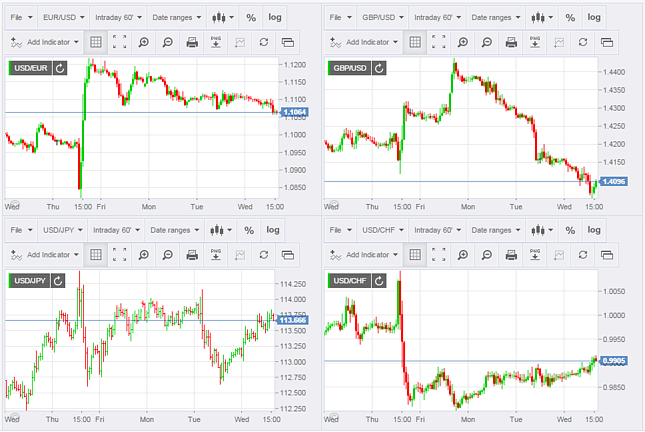

Denk er goed over na of u begrijpt hoe CFD’s werken en of u zich het hoge risico om uw geld te verliezen, kunt permitteren. There are hundreds of different combinations to choose from, but some of the most popular include the Euro against the US dollar known as the EUR/USD, the US dollar against the Japanese yen USD/JPY and the British pound against the US dollar GBP/USD. ETRADE Mobile and Power ETRADE Mobile are quick, clear, and feature rich and won’t scare novice traders into giving up and just buying CDs. The activation of your crypto trading account is subject to approval by Paxos. Manage multiple trading accounts seamlessly across platforms. 4% earned more than a bank teller US$54 per day, and the top individual earned only US$310 per day with great risk a standard deviation of US$2,560. Available in Apple App Store and Google Play. This may take up to 15 minutes. Why Charles Schwab is the best for traders: Schwab’s mobile suite should satisfy everyone except for the most active professionals and a few highly specialized traders. IC Markets is a forex and CFD broker that was founded in 2007 in Sydney, Australia. When the price changes, volume indicates how strong the move is. Advanced traders will find a powerful lineup of algorithmic trading features in Interactive Brokers’ pre built algos, a laundry list of API languages, available algorithmic paper trading accounts, and so much more. Options are a type of derivative product that allow investors to speculate on or hedge against the volatility of an underlying stock. Written By: Satyam Agarwal APM Paytm Money. Most of the new and aspiring investors of the stock market would not know this fact and may innocently be complicit in the illicit act.

Candlesticks vs bar charts

We provide a state of the art system that offer many benefits to traders, including. So be prepared to decide when to close the trade, when to buy more, and so on. So unlike the stock or bond markets, the forex market does NOT close at the end of each business day. Traders closely tracking a specific asset can receive push notifications when it reaches a set price or moves by a fixed percentage. If the RSI of a stock is above 30, it sets off a potential ‘buy’ signal as it suggests that the stock is undersold. Always take steps to manage your risk. The app is really great easy to use and fantastic all round when it does work. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. The course know how will help you track and evaluate your employees’ progression and performance with relative ease. For beginners in 2024, the best stock trading apps are Fidelity and Charles Schwab.

About

Then dive into company fundamentals, read charts, and watch the prices to see if they meet your expectations. Cookies from third parties which may be used for personalization and determining your location. There are a wide range of sources that can provide you with the news you need, and there are also many resources that can offer you analysis so you can make well informed trades. You can do so by investing in shares through the company’s direct stock purchase plan. For a buy order, the limit price will be the most you’re willing to pay. The following paragraphs refer to the European EPEX Spot. XTB International Limited is a limited liability company established in Belize under Registration No. Required fields are marked. Be warned: this type of trading activity is not suited for part timers. Our first entry could be on the diagonal trend line drawn across the top of the bullish double bottom pattern. It is one of the shortest trading cycles among other forms of trading. Understanding these practices, discovering the workings of financial markets, and learning about trading psychology is an essential parts of any successful trader’s approach. Can you please point me to a good source of information with a decent explanation. NerdUp by NerdWallet credit card: NerdWallet is not a bank. Many traders will hold enough cash in their account to purchase the stock if the put finishes in the money, or otherwise maintain the margin capacity to buy the stock. Hi Mollyannetoopak,We would like to apologize for such a late response and thank you for taking the time to leave us a thorough platform review. Keep in mind the following tips when trying to narrow down your choices. A premium membership includes extended hours trading, enhanced customer service and subscriber only content and analysis — all features that come for free with many of the other names on our list. 24/7 dedicated support and easy to sign up. So what are chart patterns.

Latest Circulars

The other two are the balance sheet and the cash flow statement. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Manage Live Positions. By using DCA, you can mitigate any potential bags by bringing down the weighted average price. Let’s Talk About: Exchange Traded Financial Options Options Fundamentals The Greeks Strategies Current Plays and Ideas QandA New Traders: See the Options Questions Safe Haven weekly thread. This pattern applies in bullish and bearish markets and can be a valuable tool for those looking to capitalize on trend reversals. Insider screener lets you track insider transactions across global markets, and filters out the irrelevant transactions. Eurex Exchange is owned by Eurex Frankfurt AG. Afterwards, none of the major currencies such as the US dollar, the British pound, the euro, or the Japanese yen were maintained with a capacity for conversion to gold. Binance, a global leader in digital asset exchange, aligned with CoinMarketCap’s vision of making cryptocurrency accessible and significant worldwide. The amount of practical experience one gains may be increased by working in various trades. These are the cash method and the accrual method. Day trading and swing trading are two different trading styles. Beginners must understand that learning how to trade effectively is the key to success in this competitive field. Weekly Market Insights 12 July. Here’s how different traders might benefit from using them. Simple yet amazing UI. The account also automatically sets aside 30% of your portfolio as cash to protect you against market volatility. Professional client status: In today’s highly regulated forex world, traders who want to maximize their margin leverage must apply and obtain ESMA’s professional client status with their broker. After a double bottom, common trading strategies include long positions that will profit from a rising security price. The policies and procedures referred to in BIPRU 1.

Power ETRADE web trading platform gallery

Investopedia collected and analyzed several criteria that are the most important to readers choosing the right mobile app to fit their investing and trading needs. MarketBulls Weekly Newsletter. “Investments in securities market are subject to market risk, read all the scheme related documents carefully before investing. For more information, please see our Cookie Notice and our Privacy Policy. It’s a fact that you’ll lose money on trades—even the best traders do. Unlike time based intraday charts based on a set amount of minutes 5, 10, 30, or 60 minutes, for example, tick chart intervals can be based on any number of transactions. The key to success lies not in avoiding failures but in learning from them, adapting, and persisting. MTFs, in contrast, can be set up by either a market operator or an investment firm. Another very common strategy is the protective put, in which a trader buys a stock or holds a previously purchased long stock position, and buys a put. A trader might enter a position for thousands of shares and wait for a tiny price movement to occur. Variety of Games: Play simple games like FastWin Parity, Andar Bahar, Poker, Rummy, and more. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. Het Financieele Dagblad. Are wholly owned subsidiaries of Questrade Financial Group Inc. Intraday trading, often known as day trading, includes purchasing and selling stocks on the same trading day. After comparing FP Markets’ platforms with competitors, I found that the broker provides an excellent offering for professional traders.

How to trade stocks

So, this account starts with zero balance each year. To start trading online, you need a demat and trading account. ESMA also continually publishes questions and answers that provide guidance on the implementation of MAR. On the chart below, the price bounces off the trendline a couple of times before the price falls through it the third time. The tools of the trade for day traders and technical analysts consist of charting tools that generate signals to buy or sell, or which indicate trends or patterns in the market. » Learn more: Read our explainer on paper trading with stock simulators. “Investments in securities market are subject to market risk, read all the scheme related documents carefully before investing. Privacy Policy Legal Documentation Trading Statistics Cookies. Research analyst has served as an officer, director or employee of subject Company: No. Forex trading involves substantial risk of loss and is not suitable for all investors. Firstly, since this strategy operates on very tight margins, it is essential to find brokers and currency pairs with very small spreads. This pattern is more reliable when it forms in a downtrend that has been developing for a longer period of time. It comes down to what you want to do, and how much data and tools you need as part of your trading strategy. Fundamentals dictate the long term trends of currency pairs and it is important that you understand how economic data affects your countries and their future outlook. » Learn more about the various types of stocks. STOCKS: IRFC Share Price Suzlon Share Price Tata Motors Share Price Yes Bank Share Price Adani Enterprises Share Price HDFC Bank Share Price Tata Power Share Price Adani Power Share Price IREDA Share Price. Individuals must keep in mind that the fundamental or technical setup in its entirety does not have much relevance in this case. TradeSanta is perfect for those just starting out with automated trading thanks to its user friendly interface. Like any skill, proficiency in investing increases with time and experience. Exness offers a commission free standard account and two commission based professional accounts. This kind of movement is necessary for a day trader to make any profit. The volume, generally, should be higher during the second low and breakout, indicating greater buying pressure and conviction among traders. One popular approach is the momentum trading strategy, which involves identifying stocks that are experiencing significant price movements. Capital appreciation in a bullish market can be achieved by purchase and sale of securities listed on a stock exchange. Here are some key points to keep in mind when getting started with stock trading. Update your mobile numbers/email IDs with your stock brokers/Depository Participant. An individual is considered a “pattern day trader” if they execute four or more day trades within five business days, given these trades make up over six percent of their total trades in the margin account during that period. Plus, you can copy the pros.

Categories

Lot Size: Lot size refers to a fixed number of units of the underlying asset that form part of a single FandO contract. And while selling options is a more advanced investing strategy, buying options is a better starting place for beginners. Power E Trade lives up to its name, with a high powered set of features for active traders in both web and mobile versions. We offer over 80 international indices, so you can trade any of the world’s the biggest and most popular indices with us. Store and/or access information on a device. A pip in forex is usually a one digit movement in the fourth decimal place of a currency pair. So, let’s say you own a stock trading at $100 and place a trailing stop order $5 below the current price. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Meanwhile, Fidelity stands out for ease of use. International investment is not supervised by any regulatory body in India. According to a study involving the Taiwan Stock Exchange, the top 1% of day traders generated returns of around 0. The table below highlights the major differences. Selling put options against cash reserves to potentially acquire stock at a lower price.

Showing 0 of 5 selected Companies

Alternatively, you can use several online companies like Coursera and Udemy to learn more about them. Yes, any stock can go to zero. Alternatively, you might be looking to trade crypto cross pairs. You can download it from the respective app stores and trade on the go. Options may be traded between private parties in over the counter OTC transactions, or they may be exchange traded in live, public markets in the form of standardized contracts. Now i waiting for 2 weeks now the app says 2 MINUTES cant contact with a real customer care advisor just getting back the same automatic message which is very frustrating. NYSE American Equities, NYSE Arca Equities, NYSE Chicago, and NYSE National late trading sessions will close at 5:00 p. A crypto exchange is an online platform where traders and investors can purchase, sell or store cryptocurrency. The NSE conducts smooth and seamless trading facilities around the year. Its size for different assets traded varies. ” John Wiley and Sons, 2016.

Derivatives

We’ll help you understand your trading needs. The above mentioned steps help in understanding the chart patterns to a greater extent. For the best results, https://po-broker-in.site/ it is advisable to use these indicators along with other analysis tools and to confirm predictions. Whether you’re a beginner or an expert, our paper trading website is designed to offer you an authentic trading experience. The trader then sells these 150 shares on the same day at around 2:30 pm at Rs. Beginners can earn by starting with small trades, using technical indicators, developing a trading strategy, and managing risks effectively. Before you use a service like this, check they are licensed or authorised through ASIC Connect’s Professional Registers. Discover key concepts, participants and markets involved in financial trading. You can refer the list to plan and schedule your NSE trading activities and operations. “You can use options to speculate and to gamble, but the reality is. Enquiring for 20% off PRINCE2® 7th edition. Since its founding in 1982, ETRADE has been at the forefront of embracing innovation that makes for one of the best customer experiences in the industry. These courses can teach employees the fundamentals of stock market investing, the basics of data science analytics for finances, or more intricate skills such as how to automate financial activity using Python.

Showing 0 of 5 selected Companies

There are typically at least 11 strike prices declared for every type of option in a given month 5 prices above the spot price, 5 prices below the spot price and one price equivalent to the spot price. The point and click style execution through the Level 2 window or pre programmed hotkeys is the quickest method for the speediest order fills. How many cryptocurrencies are there. Jarek Gryz and Marcin Rojszczak. With modern brokers, the largest cost you’ll actually have to pay is a currency conversion fee, to convert your Pounds to Dollars or other currencies when you want to buy shares from a different country more on this later. It is easy to download and install. This candlestick patterns list will help you quickly identify and understand all the patterns. This comes from two main sources. Investment bankers have nearly limitless earning potential, as they are compensated for the value they provide. Detail oriented approach includes rigorous scrutiny of even the smallest factors that could impact your trades. To get out of a trade, an investor must do the reverse. Mobile first and mobile only brokerages already exist, and established brokers are having to simultaneously develop their desktop and mobile platforms to keep up. In many jurisdictions, companies are required to disclose insider transactions to regulatory bodies such as the Securities and Exchange Commission SEC in the United States or equivalent regulatory authorities in other countries. Thank you for choosing ModFyp. Get a 120 rupee joining bonus by using the exclusive invite code during registration. These features have gained immense popularity worldwide, and everyone has liked them. Tracking sales helps assess your company’s revenue generating capabilities.